Medical Coverage

Overview

The State of Rhode Island offers eligible active employees three medical plans – Anchor, Anchor Plus and Anchor Choice with HSA. All plans are administered by Blue Cross & Blue Shield of Rhode Island (BCBSRI). Watch the video and click on the tabs below to learn more about your medical coverage options. See Prescription Coverage if you want more information on the prescription coverage that accompanies your medical coverage.

Note: This video refers to electing a Primary Care Physician (PCP) to coordinate care. While it’s always a good idea to establish a relationship with a PCP, employees (except RIBCO, RITA, non-Union State Police, non-Classified union and non-union education and college employees) who are enrolled in the Anchor plans are not required to designate a PCP to coordinate their care.

Coverage Details

The BCBSRI group policy number is 01002826.

How Are the Plans the Same?

Keep in mind the following whether you are enrolled in the Anchor Plan, the Anchor Plus Plan, or the Anchor Choice Plan with HSA:

- All three plans cover the same medical services.

- All three plans use the same BCBSRI network locally as well as the national Blue Cross and Blue Shield Association network.

- All three plans require you to pay 10% of the cost (your coinsurance) for covered medical expenses when you visit a network provider, after you’ve met your deductible.

- Not sure how deductibles, coinsurance, copays and out-of-pocket maximums work together? Select the plan of your choice below for explanations and examples.

- Remember that you never pay anything for preventive services. In order for preventive services to be covered without cost-sharing, you must receive services from a BCBSRI network provider, and certain age, sex, and risk profile requirements may apply.

- All three plans have a combined medical and prescription out of pocket maximum (OOPM)

- All three plans allow you to save big when you obtain voluntary major imaging services at a freestanding facility not affiliated with a hospital group.

- Before you've met your deductible: Your out-of-pocket cost for imaging services can be much lower if you use a freestanding facility.

- After you've met your deductible: Your cost for voluntary major imaging services is covered in full if you use a freestanding facility.

- See the Freestanding Facility flier for more information on how this plan feature works as well as a non-exhaustive list of freestanding facility locations around Rhode Island and nearby in Massachusetts and Connecticut. You can also check and compare imaging costs by logging in to bluecareconnectRI.com and selecting “Find Care”.

- All three plans will require prior authorization for select services to ensure they are medically necessary.

- For medically necessary in-network services, your PCP will need to obtain prior authorization from BCBSRI.

- For medically necessary out-of-network services, YOU will need to obtain prior authorization from BCBSRI.

- See the Medical Necessity flyer for more information on how this plan feature works as well as lists of in-network and out-of-network services that require prior authorization.

- All three plans have a virtual musculoskeletal (MSK) benefit through a partnership with Hinge Health. This comprehensive digital MSK care program combines personalized exercise therapy, wearable technology, health coaching, and education to help reduce chronic pain and improve joint and muscle health. You don’t need a referral to use it, and there is no cost to you for this coverage.

- All three plans provide access to video-chat medical services through Doctors Online.

- For common, non-emergency medical conditions (including some behavioral health concerns), you can take advantage of Doctors Online. Doctors Online lets you see and talk to a board-certified doctor from your mobile device or computer without an appointment, 24/7, and most visits take about 10-15 minutes.

- See the Doctors Online flyer for more information.

How are the Plans Different?

As you can see, there’s a lot that’s the same across the State’s three Anchor medical plans. There are some differences though. One difference is in the kind of tax advantaged accounts you can have. For Anchor and Anchor Plus, you are eligible to have a general purpose health flexible spending account (FSA). But because Anchor Choice is an HSA-qualified high deductible health plan you are not eligible for a general purpose health FSA. Instead, Anchor Choice enrollees will receive a free* health savings account (HSA) through BCBSRI. The State makes contributions to employee HSAs** and employees can make their own pre-tax HSA contributions as well. For additional HSA details, review the HSA FAQ and visit the HSA page. Anchor Choice enrollees are also eligible to have a limited purpose health FSA for qualified dental and vision expenses.

The biggest difference in the three plans is when you pay for coverage. Do you pay more in premiums (co-shares) from your paycheck, or (potentially) more when you seek medical services? It’s important to do the math: estimate your probable expenses and consider each plan’s deductible and out-of-pocket maximum. If you need help, talk to ALEX®, the State’s online decision support application. ALEX is the host of a unique online experience that will help you understand and make decisions about your health benefits. “Talking” with him is easy. He will ask some basic questions about your personal situation (your answers remain strictly anonymous), crunch some numbers, explain your available benefits options, and make recommendations based on your specific circumstances.

Don’t forget that you can also visit the virtual benefits fair for vendor presentations and materials. The virtual benefits fair site can help you better understand your plan options and make the best choice for you and your family.

* If you disenroll from Anchor Choice for any reason your HSA would be subject to a $2.50 monthly service charge that would be deducted from your HSA regardless of balance.

** State contributions are made biannually with half deposited in January and the other half deposited in July. The State’s HSA contributions are NOT pro-rated for employees that enroll after January 1 and July 1.

Livongo Diabetes Management Support Program

What is Livongo? Livongo is a health program that combines advanced technology, coaching, and support for weight management and mental health to help people live happier, healthier lives. Livongo is brought to the State of Rhode Island through its relationship with Blue Cross & Blue Shield of Rhode Island.

Available personalized plans:

Who can join? The program is offered at no cost to employees, retirees and dependents that are enrolled in one of the State of Rhode Island Anchor medical plans. Only members with certain conditions are eligible for these benefits. For more information, contact (800) 945-4355.

What do I get if I sign up?

- Connected devices: Depending on your health goals, you could receive a free blood glucose meter, blood pressure monitor, and/or smart scale. They all send readings right to your private account on an easy-to-use app.

- Support when you need it: Ask expert coaches your questions on nutrition, medications, or anything else related to your health.

- Digital behavioral health support: Get 24/7 access to practical tips and techniques that help you better manage stress, sleep, anxiety, depression, and more.

How do I enroll? To enroll in Livongo, you must first be enrolled in one of the State’s Anchor medical plans. You must also meet the health criteria for each program you wish to enroll in. If a Livongo program is not offered by State of Rhode Island, or if you do not meet the specific health criteria of that program, you will not be able to enroll. This a self-management program and does not replace medical care by a physician.

- Enroll today: be.livongo.com/RHODEISLAND/new

- Use registration code: RHODEISLAND

Blue365 Discount Program

State employees and covered dependents enrolled in one of the State Anchor medical plans are eligible for the Blue365 discount program.

What is Blue365? Blue365 is an exciting program that offers exclusive health and wellness deals to help keep you healthy and happy, every day of the year. Blue365 offers you great discounts from top national and local retailers on fitness gear, gym memberships, travel, healthy eating options and much more.

How do I take advantage of Blue365? Easily register by clicking “Join” here, and providing the required information. Once you’re registered, browse the categories, sort by interests, keywords or locations, and redeem offers to get discounts.

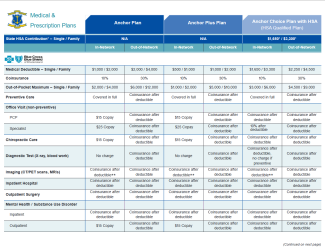

Plan Comparison

Click on the chart below to see how Anchor, Anchor Plus and Anchor Choice compare across specific coverages.

Plan Documents

The Summaries of Benefits and Coverage are brief plan overviews presented in federally-mandated standard formats.

The Summary Plan Descriptions, or what BCBSRI refers to as "Benefits Booklets," are comprehensive plan descriptions regarding the terms of coverage, including exclusions and limitations.

A brief overview of how plan coverage works when someone has dual coverage.

Any State employee that satisfies all of the following criteria is eligible to enroll:

- Holds a non-seasonal position

- Scheduled to work at least 20 hours per week

- Not on leave without pay (LWOP)

The following dependents are also eligible for enrollment:

- Spouse

- Common Law Spouse

- Married federal income tax filing status – The IRS allows common law spouses to file their taxes married-joint if they live in a state like Rhode Island that recognizes common law marriage. Because common law spouses receive the same favorable pre-tax benefits treatment as spouses that can provide a marriage certificate, employees wishing to cover a dependent as a common law spouse must provide a copy of their most recent federal income tax filing showing married-joint or married-separate tax filing status. In the absence of such a tax filing status, the dependent may still be eligible for coverage as a domestic partner.

- Domestic partner

- Imputed Income – Pursuant to federal guidance, under the State employee health plan the fair market value of any health coverage extended to a domestic partner will be imputed to you as income on your paycheck. This imputed income would be added to the your federal taxable gross wages, State taxable gross wages and social security taxable wages. Additionally, any coverage provided to a domestic partner is paid for on an after-tax basis. You will have additional tax withholdings based on the imputed income and the increased taxable wages due to the reduction in pre-tax contribution. The amount of imputed income is generally around $200 per pay period for medical/prescription, dental and vision coverage, and the amount of the reduction in pre-tax contribution is generally around $100 for the same coverage. This means that you will have additional tax withholdings based on approximately $300 per pay period. Generally, the additional tax withholdings will be in the same proportion as your normal tax withholdings are to your regular pay.

- Marriage – If you and your domestic partner get married, it is YOUR responsibility to inform the Office of Employee Benefits in writing immediately. Your failure to do so will prevent you from obtaining refunds of additional tax withholdings based on imputed income. The Office of Employee Benefits will not coordinate such refunds if it is not notified within 31 days of the date of the marriage.

- Termination of domestic partnership – If your domestic partnership ends, you will not be able to drop your domestic partner from your coverage until open enrollment (for effect January 1 of the following year) unless your domestic partner experiences a qualifying status change.

- Addition of new domestic partner – If you drop your domestic partner, you will not be able to add a new domestic partner for at least 6 months, assuming your new domestic partner meets all eligibility requirements.

- Children* (Up to the end of the month in which they reach age 26. At that time, coverage will be automatically terminated with no action required by the employee, and COBRA continuation coverage will be offered.)

* Children of domestic partners are not eligible unless they are also the natural/adopted child of the employee, or the employee has legal guardianship.

Enrollment Periods

Employees may enroll in or change their election for medical coverage during one of the following periods:

- Within 31 days of date of hire or a qualifying status change

- Open enrollment

Enrollment Process

Step 1: Do your research!

- Visit the virtual benefits fair to watch recorded BCBSRI and CVS Caremark presentations.

- Review your past medical and prescription expenses and think about the coverage you need in the future, then talk to ALEX.

- Watch the Understanding Your Anchor Medical Plans whiteboard video posted above

- Review the detailed benefits information on the "Coverage Information" tab of this page

Step 2: Enroll!

Visit the Benefits Enrollment page for all the guidance you’ll need to enroll in benefits or make changes to existing benefits elections.

Medical Coverage Waiver

You may formally waive the State medical and prescription coverage if you have other coverage. Waiver elections must occur in ERP (Workday) and can only occur at the time of hire or during the annual open enrollment period unless a status change occurs during the year. If you waive medical coverage in ERP (Workday), you may elect to receive an opt-out payment if you are eligible to do so. You are ineligible to receive the opt-out payment if:

- Your alternative coverage is state-subsidized under a Medicaid program (Rite Care, MassHealth, etc.);

- Your alternative coverage was purchased through a health insurance marketplace under the Affordable Care Act (e.g., HealthSource RI); or

- Both you and your spouse were hired by the State on or after June 29, 2014 and you are both covered under a State family plan (higher-earning spouse must pay the co-shares and the lower-earning spouse is ineligible to receive the medical waiver opt-out payment).

Medical opt-out payment credit accrues over the course of the fiscal year at the rate of $38.50 per biweekly pay period. Payments are made once each year on the first payday in August. The maximum payment amount for a given fiscal year would be $38.50 times 26 pay periods, or $1,001. However please note that if the medical waiver election was not in place for the full 26 pay periods the opt-out payment amount may be smaller than the maximum. The opt-out payment is taxed like normal wages and appears as a second paycheck on the applicable pay date.

The opt-out payment is not granted by default - a formal waiver election must be submitted in ERP (Workday), a copy of your medical ID card showing your other coverage must be provided, and the opt-out payment must be elected.

See below for 2025 premium rates—i.e., your co-shares. Premium co-shares for prior years can also be found below.

A co-share is the amount that is deducted from your pay each pay period for your coverage. It is your “share” of the overall plan cost. Co-shares vary by individual vs. family coverage, as well as by annual salary and full-time/part-time status. Co-shares listed here are for classified and unclassified State employees only. Non-classified union & non-union employees working in higher education should refer to their college/university website (URI, RIC, CCRI) for their co-shares.

Co-share amounts are determined as a percentage of the full plan costs, or "working rates."

Bi-weekly Co-share Rates

* Salary ranges do not include overtime or other non-salary wages.

** If your scheduled work hours are fewer than the full hours specified for your position, you will be classified as a part-time employee. Your co-share amount is determined according to the full-time annual salary for your job specification, not your part-time wages actually earned.

* Salary ranges do not include overtime or other non-salary wages.

** If your scheduled work hours are fewer than the full hours specified for your position, you will be classified as a part-time employee. Your co-share amount is determined according to the full-time annual salary for your job specification, not your part-time wages actually earned.

Historical Rates

2024 Working Rates

2023 Co-share Rates

2023 Working Rates

Co-Share Rates

- For 26 pay-period classified and unclassified union and non-union employees

- For 20 pay-period classified and unclassified union and non-union employees

- For RITA and State Police Command Staff

Working Rates (full plan costs)

Co-Share Rates

- For 26 pay-period classified and unclassified union and non-union employees

- For 20 pay-period classified and unclassified union and non-union employees

- For RITA and State Police Command Staff

Working Rates (full plan costs)

Co-Share Rates

- For 26 pay-period classified and unclassified union and non-union employees

- For 20 pay-period classified and unclassified union and non-union employees

- For RITA and State Police Command Staff

Working Rates (full plan costs)

In-Network Claims

To view your in-network claims history, please log in to your account at mybcbsri.com.

Out-of-Network Claims

Please ask the non-network provider who treated you for an itemized statement (including diagnosis and procedures) and a receipt. The receipt should include the following information:

- Diagnosis code/description

- Health service code/CPT code/description of service or item

- Charge for each service

- Patient ID number

- Patient name

- Provider name

- Provider address

- The provider’s letterhead/logo

- Provider tax ID number

- Specific date(s) of service

Submit clear black-and-white copies of these items to BCBSRI with a letter explaining your request. Be sure your letter includes your name, address, and member ID number.

Send your copies and letter to:

Blue Cross & Blue Shield of Rhode Island

Attn: CARE Team Claims Department

500 Exchange Street Providence, RI 02903

What is the Form 1095-C?

The federal Affordable Care Act requires certain employers to offer health insurance coverage to full-time employees and their dependents. Further, those employers must send an annual statement to all employees eligible for coverage describing the insurance available to them. The Internal Revenue Service (IRS) created Form 1095-C to serve as that statement.

Who receives a Form 1095-C?

Every employee who is eligible for health insurance coverage will receive a Form 1095-C. Additionally, former employees and pre-65 retirees will receive Forms 1095-C.

What’s on the Form 1095-C?

The form identifies:

- The employee and the employer

- Which months during the year the employee was eligible for coverage

- The cost of the cheapest monthly premium cost the employee could have paid

When is the Form 1095-C distributed?

The IRS deadline for furnishing Forms 1095-C to employees is March 2nd each year. It will be mailed to the employee’s home address in advance of that date.

Do I need to wait until I receive my Form 1095-C before I file my taxes?

There is no need to wait until you receive your 1095-C to file your taxes. Under the federal Tax Cuts and Jobs Act, the individual shared responsibility payment was reduced to $0 for months beginning after December 31, 2018. Form 1040 no longer has a full-year health care coverage or exempt box, and Forms 1095-C are no longer required to be entered into the tax return and should be kept by the taxpayer for their records.

I received my Form 1095-C but the codes and amounts displayed in Part II make no sense to me. What are the codes and amounts displayed?

In part II, “Employee Offer of Coverage,” there’s information about the coverage offered to you, the affordability of the coverage offered, and the reason why you were or were not offered coverage. The information must be reported on a month-by-month basis unless the information is the same for all 12 months.

- Line 14 is used to report whether an offer of coverage was made to an employee for each month of the year.

- 1A - Your employer made a qualifying offer of healthcare coverage that is affordable based on the federal poverty line to you, your spouse, and your dependent(s), if any.

- 1B - Your employer made a qualifying offer of healthcare coverage to you.

- 1C - Your employer made a qualifying offer of healthcare coverage to you and your dependent(s).

- 1D - Your employer made a qualifying offer of healthcare coverage to you and your spouse.

- 1E - Your employer made a qualifying offer of healthcare coverage to you, your spouse, and your dependent(s).

- 1F - Your employer made an offer of healthcare coverage to you, your spouse, and your dependent(s), if any, that does not qualify as providing "minimum value".

- 1G - You were not a full-time employee but were enrolled in healthcare coverage.

- 1H - Your employer did not make an offer of coverage or the offer was not a qualified offer.

- Line 15 is used to report your share of the lowest-cost monthly premium for self-only qualifying coverage. The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such as family coverage.

- Line 16 explains why you did or did not receive an offer of coverage. This line provides the IRS information needed to determine whether your employer satisfied the employer mandate. None of this information affects your eligibility for the premium tax credit.

- 2A - You did not work any day in the month.

- 2B - You were not full-time during the month.

- 2C - You were enrolled in coverage for the entire month.

- 2D - You were in a waiting period and not yet eligible for coverage per the Affordable Care Act regulations.

- 2E - You were covered by a Union plan.

- 2F - Your employer offered you coverage that was considered affordable based on your W-2 wages, but you did not enroll.

- 2G - Your employer offered you coverage that was considered affordable based on the federal poverty line, but you did not enroll.

- 2H - Your employer offered you coverage that was considered affordable based on your rate of pay, but you did not enroll.

What do I do if I need a reprint of my Form 1095-C?

- Please send an email to doa.oeb@doa.ri.gov requesting a new copy. Please be sure to indicate the year for which you need the Form 1095-C.

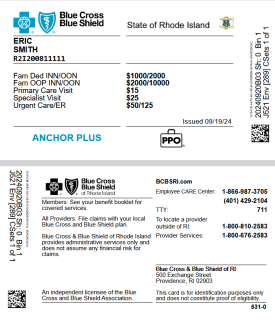

- Each person enrolled will have their own BCBSRI ID card.

- Your ID number will have the prefix of "R2I". Please present your new card to providers when utilizing services in 2025.

- For all other assistance with your BCBSRI ID card, please call the BCBSRI CARE Center. BCBSRI State of Rhode Island Employee CARE Center at (401) 429-2104 or 1-866-987-3705. CARE Center hours are Monday–Friday, 8am–8pm and Saturday, 8am–12pm.

Please contact Blue Cross & Blue Shield of Rhode Island (BCBSRI) or access their suite of helpful resources if you have questions regarding your medical coverage or your health savings account (HSA):

- Call the State of Rhode Island Employee CARE Center:

- (401) 429-2104 or 1-866-987-3705

- CARE Center hours are Monday–Friday, 8am–8pm and Saturday, 8am–12pm.

- To access your account go to bluecareconnectRI.com (the member portal) or download the BlueCare Connect RI app (Be sure you see “RI” in the app’s name.) to view and manage your BCBSRI medical coverage.

- If you have/had other BCBSRI coverage and you’re trying to access your State of RI BCBSRI information through bluecareconnectRI.com you will need to register on bluecareconnectRI.com with your State of RI BCBSRI ID number.

- Opt in for BCBSRI's text messaging service, where you can count on important reminders about your health benefits.

- Visit your Blue StoreSM in East Providence, Cranston, Lincoln, Narragansett and Warwick. Learn more at bcbsri.com/yourbluestore.