Pre-65 Retiree Medical & Prescription Coverage

Overview

There are three State-sponsored plans for State retirees that are under age 65/non-Medicare-eligible. All plans are administered by Blue Cross & Blue Shield of Rhode Island (BCBSRI). State subsidies are applicable to these three plans:

- Retiree Anchor Plan

- Retiree Anchor Plus Plan

- Retiree Value Plan

Alert!

You must IMMEDIATELY start collecting your State pension upon retirement in order to qualify for State-sponsored medical and prescription coverage as well as any State subsidy.

Coverage Details

State Pre-65 Coverage

State retirees may elect one of three plans: Retiree Anchor, Retiree Anchor Plus and Retiree Value.

Retiree Anchor and Retiree Anchor Plus offer identical coverage as the Anchor and Anchor Plus plans for active employees except for three things:

- No requirement for primary care provider (PCP) coordination of care (i.e., no higher co-pay or coinsurance for visiting specialists without a PCP referral)

- No place of service tiering feature for major imaging services (i.e., major imaging services such as CT/PET scans and MRIs are NOT covered in full after deductible even if a freestanding imaging center is used)

- Premium rates

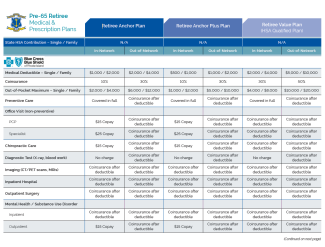

Plan Comparison

See below for how the pre-65 retiree health plans compare. Visit the Glossary page for more information on key terms like coinsurance, deductible and out-of-pocket maximum.

Plan Documents

A comprehensive description regarding the terms of coverage, including exclusions and limitations

You are eligible to enroll in State-sponsored medical and prescription coverage for you and your family if:

- You were a State employee immediately prior to retirement, and

- You immediately start collecting your State pension upon retirement. For this purpose, "retirement" means formally retiring through ERSRI and having an ERSRI retirement effective date.

Spouses, dependents, and public school teachers that retire through ERSRI are also eligible to enroll, but they are not eligible for any State subsidy towards the cost of their coverage..

Judges, legislators and State police troopers: click here for pre-65 retiree health coverage information.

Enrollment Periods

Retirees may enroll in State-sponsored medical and prescription coverage during one of the following periods:

- Upon retirement from State service

- Open enrollment (generally the month of November for coverage effective January 1 of the following calendar year)

- Within 31 days of a qualifying status change

- Turning age 59—You may enroll for the month of your 59th birth month, or within 31 days of your 59th birthday (coverage effective the first of your birth month)

Except for enrollments occurring during the open enrollment period and age 59 enrollments, all retiree coverage elections become effective as of the first of the month following the enrollment date.

Enrollment Process

If you are a current employee getting ready to retire, or you are a pre-65 retiree looking to change coverage within an eligible enrollment period, complete and submit the Pre-65 Retiree Health Coverage Election Form – Date of Retirement ON OR AFTER 10/1/08 to the Office of Employee Benefits as instructed on the form. If your date of retirement was before 10/1/08, please contact the Office of Employee Benefits for an enrollment form. Please note that:

- You must fill out a SEPARATE form for each person you want to enroll (for example, fill out two forms if you are enrolling yourself and your spouse).

- OEB will accept forms up to 90 days before a retiree's requested effective date.

- For new retirees, this form should be submitted to OEB after retirement paperwork is submitted to ERSRI.

Coverage Cancellation

If you want to cancel your health coverage, please submit the Retiree Health Care Cancellation Form to the Office of Employee Benefits.

See below for the full and State-subsidized premium rates for retiree medical and prescription coverage.

Any retiree subsidy percentage is applied to the applicable monthly premium rate, and the resulting amount is deducted from the retiree's monthly pension check. See State Subsidies for more information on subsidy percentages.

Historical Rate Tables

- You will receive a new BCBSRI medical ID card after enrollment.

- The alpha prefix on your ID card will change from "RIS" to "R2I", but your BCBSRI ID number will remain the same as when you were enrolled as an active employee.

- If you need any assistance with your BCBSRI ID card, please call the BCBSRI State of Rhode Island Employee CARE Center at (401) 429-2104 or 1-866-987-3705. CARE Center hours are Monday–Friday, 8am–8pm and Saturday, 8am–12pm.

Please contact Blue Cross & Blue Shield of Rhode Island (BCBSRI) or access their member portal if you have questions regarding your medical coverage:

- Call the State of Rhode Island CARE Center:

- (401) 429-2104 or 1-866-987-3705

- CARE Center hours are Monday–Friday, 8am–8pm and Saturday, 8am–12pm.

- Access your account on mybcbsri.com to view and manage your BCBSRI medical coverage