Dental Coverage (2019)

Overview

The State of Rhode Island offers eligible active employees three options for dental coverage—Anchor Dental, Anchor Dental Plus and Anchor Dental Platinum. All plans are administered by Delta Dental of Rhode Island. Coverage for participating employees is effective on the first day of state employment.

Review the Delta Dental FAQ and click on the tabs below to learn more about your dental coverage options.

Coverage Details

What's New in 2019

Anchor Dental, Anchor Dental Plus and Anchor Dental Platinum all cover basic, restorative and major restorative services as well as orthodontia. All use the same Delta Dental network. Anchor Dental is a base plan, but Anchor Dental Plus and Anchor Dental Platinum are “buy-up” options that offer even greater coverage.

New! Under the Anchor dental plans:

- Dependents up to age 26 are eligible to enroll. No student certification required.

- Sealants for children up to age 14 are covered 100%.

- Periodontal services are now part of the annual plan maximums.

- Annual plan maximums have been increased.

How Do the "Buy-Up" Options Work?

You can elect to pay a higher premium (co-share) to receive more dental coverage. Keep in mind, however, that the State’s contribution towards the cost of your coverage is the same regardless of whether you elect the base or either of the buy-up options.

Both buy-up options have more covered services and may be worth considering if you or your dependent may need additional dental services in 2019. For example, the Anchor Dental Platinum Plan provides orthodontia coverage for children and adults, and it also has coverage for implants.

Plan Comparison

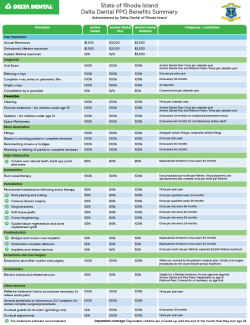

Click on the chart below to see how Anchor Dental, Anchor Dental Plus and Anchor Dental Platinum compare across specific coverages.

Plan Documents

Tips on how to utilize your Delta Dental Plan

FAQs about your Delta Dental plan, including examples of orthodontic payment calculation and how does the annual maximum work

A brief overview of how plan coverage works when someone has dual coverage.

Need Help Choosing Your Plan?

Visit the Decision Support page for tools such as ALEX®, the State Employee Benefits Guide and benefits videos & presentations that can help you better understand your plan options and make the best choice for you and your family.

Chewsi™

The State offers Chewsi™ dental to its employees for savings on dental care that may not be covered by traditional dental insurance. Chewsi is a free dental app that helps employees and their families save money on out-of-pocket dental care. The app works for all procedures. There are no limits, maximums, exclusions or claim forms to complete.

Use Chewsi when:

- You or a family member need or want a dental service that isn’t covered by your dental plan, such as sealants for children, bridges, dentures and implants, teeth whitening, adult orthodontic care, night guards and more

- You or a family member has exceeded the plan year maximum, but need additional care

- You or a family member (such as dependents over age 19 who are not full-time students, or part-time employees) do not have access to insurance

There is no cost or payroll deduction to use the app. Download Chewsi in the App Store or Google Play. Visit www.chewsidental.com to learn more.

Any State employee that satisfies all of the following criteria is eligible to enroll:

- Holds a non-seasonal position

- Scheduled to work at least 20 hours per week

- Not on leave without pay (LWOP)

The following dependents are also eligible for enrollment:

- Spouse

- Domestic partner

- If your domestic partner does not meet the definition of a dependent pursuant to Internal Revenue Code Section 152 (as modified by Section 105(b)), federal law requires that the fair market value of any State health coverage extended to your domestic partner must be imputed to you as income on your paycheck and must be reflected on the W-2 issued to you by the State of Rhode Island. For example, if you were a 26 pay-period employee covering your domestic partner under the State medical, dental and vision plans, your imputed income would be around $200 per pay period and be deducted from each paycheck.

- If you get married, or if your domestic partnership ends, it is YOUR responsibility to inform the Office of Employee Benefits in writing immediately. Your failure to do so will prevent you from obtaining refunds of co-shares paid and/or imputed income tax withheld. The Office of Employee Benefits will not coordinate such refunds if it is not notified within 31 days of the date of the change.

- Children* (Covered up to age 26) new

* Children of domestic partners are not eligible unless they are also the natural/adopted child of the employee, or the employee has legal guardianship.

Enrollment periods

Employees may enroll in dental coverage during one of the following periods:

- Within 31 days of hiring or a qualifying status change

- Open enrollment

Enrollment process

Step 1: Do your research!

- Review the detailed benefits information on the "Coverage Information" tab

- Talk to ALEX and watch informative benefits videos

- Read the State of Rhode Island Benefits Guide

- Review your coverage and expenses from 2018:

Step 2: Enroll in medical, dental and/or vision coverage online

Visit the Enrollment page for details on how to access the online enrollment system.

See below for 2019 premium rates—i.e., your co-share.

A co-share is the amount you must pay each pay period for health insurance. Co-shares vary by individual vs. family coverage, as well as by annual salary and full-time/part-time status. Co-shares listed here are for classified and unclassified State employees only. Non-classified union & non-union employees working in higher ed should refer to their college/university website (URI, RIC, CCRI) for their co-shares.

Bi-weekly co-share rates

Full-time employees

Part-time employees***

* Does not include overtime or other non-salary wages.

** Percent of health plan working rates.

*** If your scheduled work hours are fewer than the full hours specified for your position, you will be classified as a part-time employee. Your co-share amount is determined according to the full-time annual salary for your job specification, not your part-time wages actually earned.

Full-time employees

Part-time employees***

* Does not include overtime or other non-salary wages.

** Percent of health plan working rates.

*** If your scheduled work hours are fewer than the full hours specified for your position, you will be classified as a part-time employee. Your co-share amount is determined according to the full-time annual salary for your job specification, not your part-time wages actually earned.

Full-time employees

* Does not include overtime or other non-salary wages.

** Percent of health plan working rates.

Printable Rate Tables—2019 Calendar Year

Co-share rates

- For 26 pay-period classified and unclassified union and non-union employees

- For 20 pay-period classified and unclassified union and non-union employees

- For RITA and State Police Command Staff

Working rates (full plan costs)

Please contact Delta Dental to find a participating dentist, print a replacement ID card, view claims history, or obtain other information regarding the state’s dental plan:

- Visit www.deltadentalri.com

- Call 1-800-843-3582